Receipts

Create a Banking:

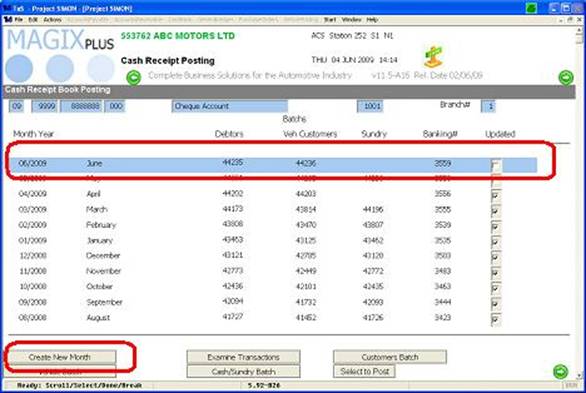

Administration/Cash Book/Posting/Receipts.

Select the month to which you want to put the banking into almost always the current month if the month isn’t displayed click on Create New Month and enter in the last day of the month.

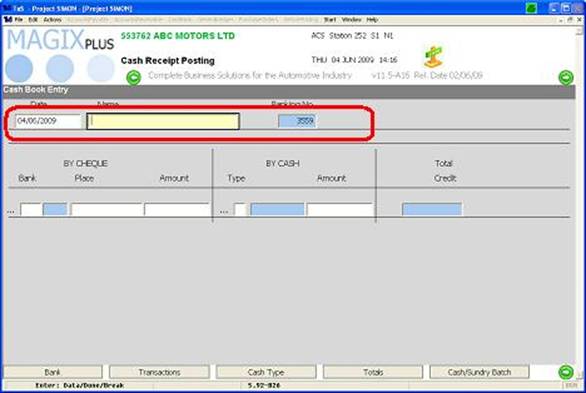

Date -The Date defaults to current date (only reason to change this is if you are back dating a banking)

Name - Name is whoever is making the payment if off a cheque would be the Cheque Drawer if Cash enter in Customers Name.

Banking No - is a system generated number

By Cheque -Enter in Details of Cheque select 3 dots for correct bank number or select Bank Tab at the bottom of screen, enter place as stated on the cheque and the amount. Select the forward icon bottom right

By Cash – Select 3 dots or Select Cash Type tab to select payment type and enter amount. Select the forward icon bottom right

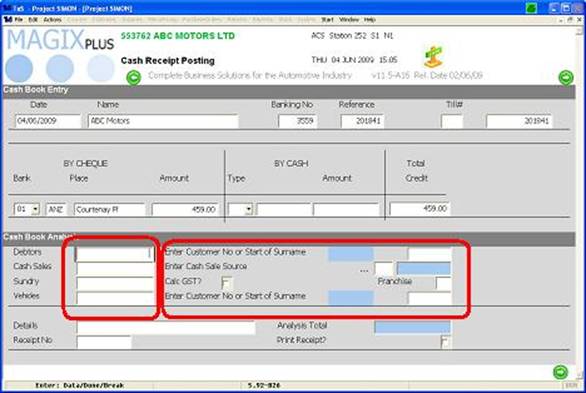

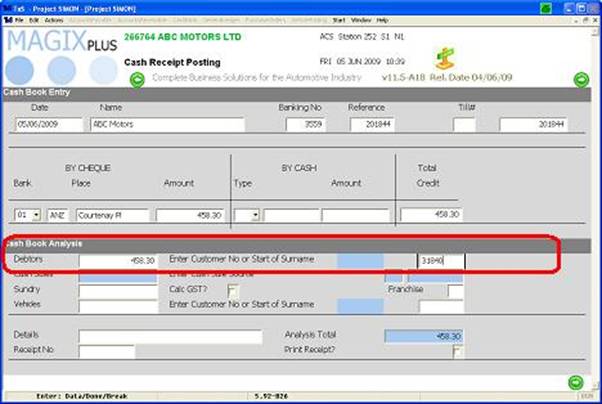

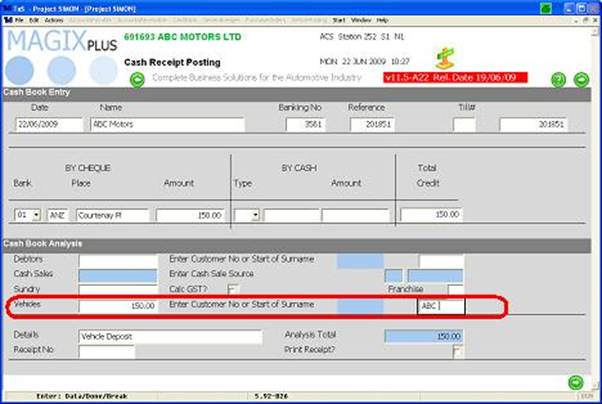

For the Cash book Analysis on the left hand side is for the Amount so depending on what the customer is paying for is to where it goes in.

Debtors – Customer who has purchased parts or had a vehicle serviced etc.

Cash Sales – Customer doesn’t have an open debtor account and must pay for goods on receiving them. (This is no longer available if on New Cash Sales).

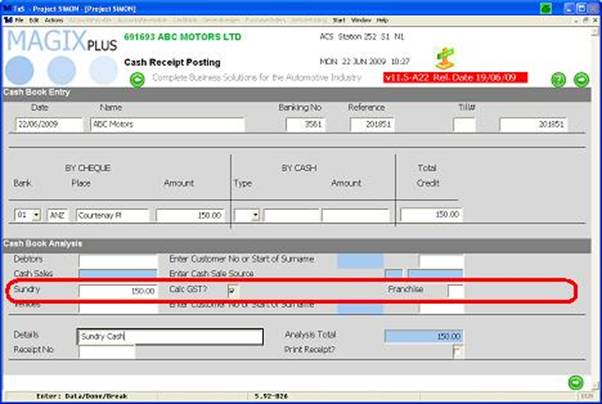

Sundry – Money being banked to a General Ledger Code

Vehicles – Customer paying for or making a deposit for a vehicle

On the right hand side is where we tell the system which customer account or code etc the money belongs to.

Enter Customer or Start of Surname – if you know the customers number then enter this in if not enter start of surname and it will list all Debtors with this name then select the correct customer

Enter Cash Sale Source – Click on the 3 dots and select the type of invoice the customer is paying for.

Calc GST?-Tick this box if the amount you are putting to sundry needs GST calculated Franchise – If you are running a number of franchises and you want to be able to identify the cash in GL reports later on.

Enter Customer or Start of Surname – if you know the customers number then enter this in if not enter start of surname and it will list all Vehicle Customers with this name then select the correct customer

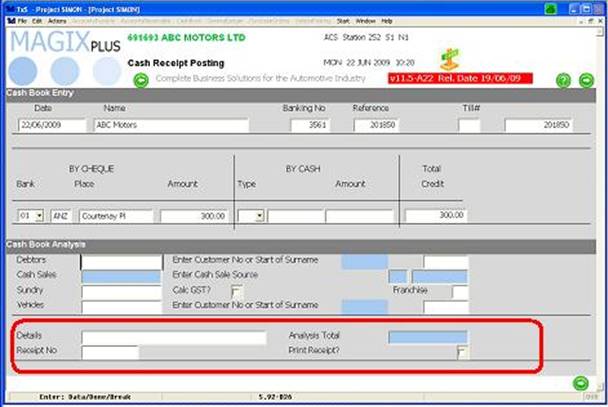

Enter in details and select Print Receipt if you wish to produce a receipt.

When receipting to a Debtors Account:

There are 2 different scenario’s which can occur which I will cover in this section.

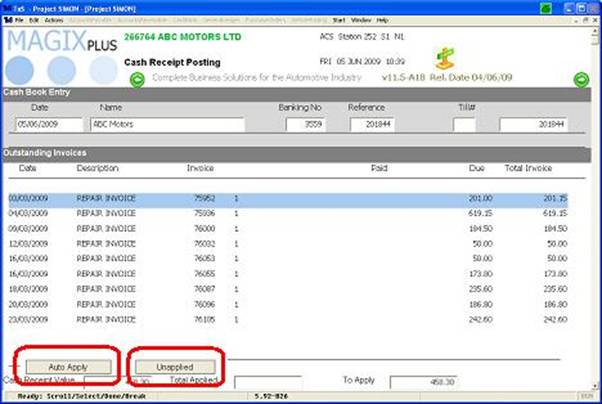

I have entered in the cheque value and the customer number.

This screen appears if the account is an Open Item Account. What is required is for you to allocate to each invoice the dollar value which is being paid for.

If the value of the payment is the total outstanding invoices then use the Auto Apply button the system will automatically apply money to each invoice. If there is a payment but no invoices or unsure what invoices to apply the payment to, use the unapplied button you will need to go apply this payment at a later date.

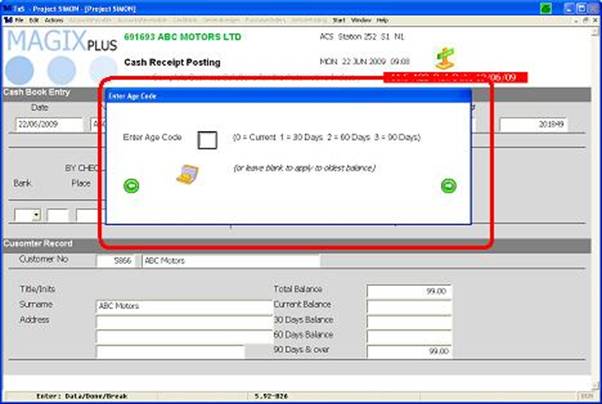

At this stage the system asks you which aging you wish to apply to if you leave the age code blank it will apply it to the oldest aging.

Receipting to sundry is used when you want to apply an amount to General Ledger code you can tick the GST area and this will automatically calculate the GST when doing the GL analysis, enter in your codes and the full amount. You can also enter in the Franchise this payment is going to if you wish.

Money receipted in vehicles is either a deposit on a vehicle or for payment of a Vehicle. Either input the customer number or start of name to identify the customer.

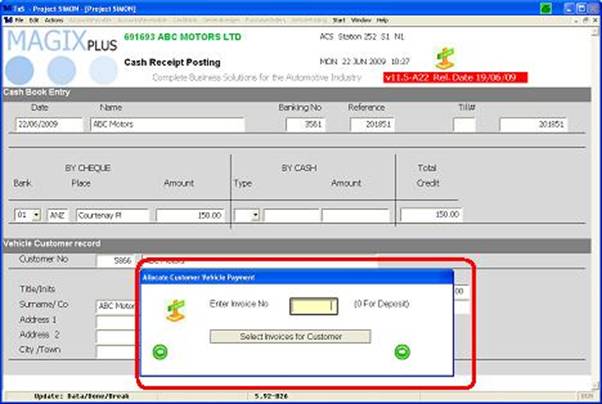

Once the customer is selected.

You are prompted to enter 0 for deposit otherwise click Select invoices for Customer and apply to the invoice that they are paying for.

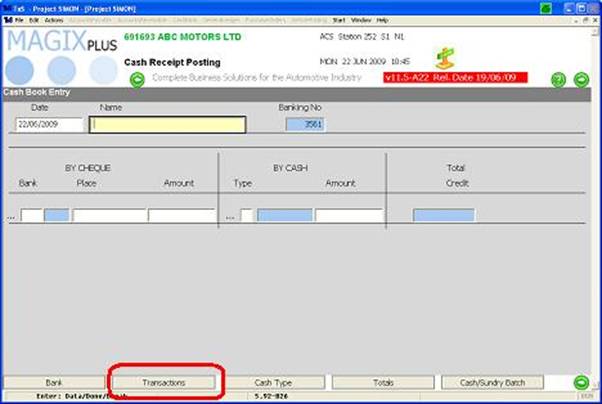

Each time an entry is complete you will come back to the first screen. See Below

If you select transactions this will list all the transactions that are in this banking, these transactions can be deleted if required by double clicking on the item then at the bottom select delete cash

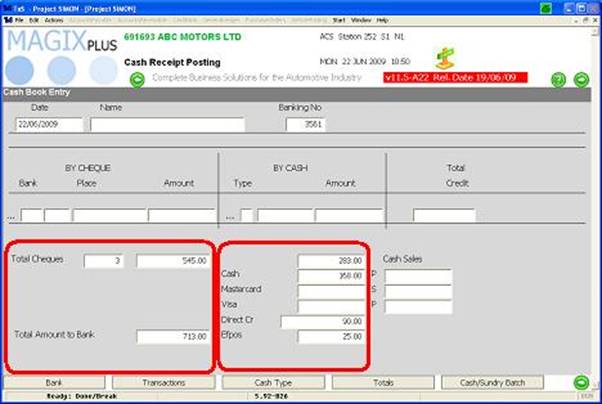

When selecting the Totals button you get this screen, it’s very important that the banking balances before closing the banking as you cannot reopen the banking.

Total Cheques is the number of cheques and what they all add up to, so the total amount to bank is Cheques and Cash added together.

This is a summary of all the Transactions within this banking the amount at the top is the total.

As long as all this balances to what you physical have you can go ahead and close the banking.