Payments

Creating Cash Payments

Administration/Cash Book/Posting/Payments (Only use for Cash Payment anything for Accounts Payable should be done through the Accounts Payable Payment Process)

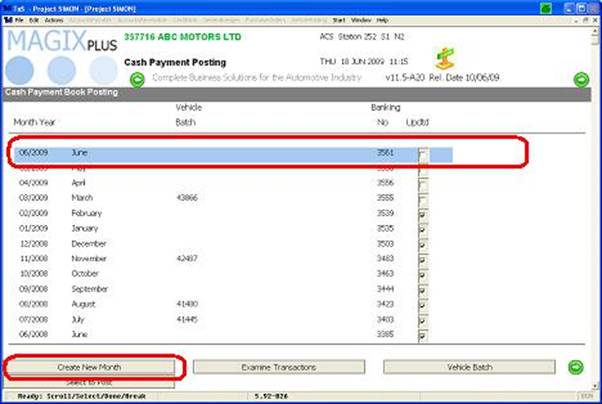

Select the month you wish to enter the payment into, if the Month you wish to post the payment isn’t there select Create New Month.

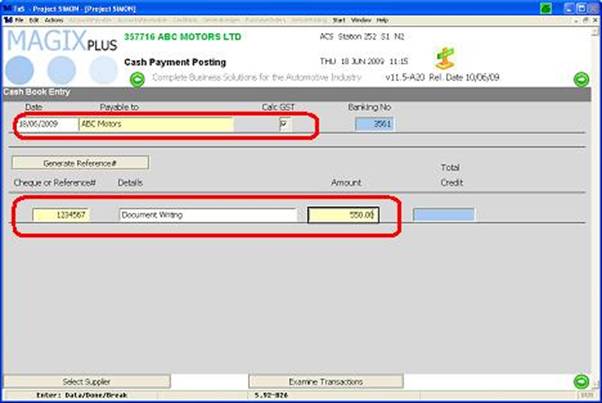

Enter Cheque Date, Name of Supplier and whether the payment incurs GST, followed by the Cheque Number and a quick reference to what the payment is for and the amount.

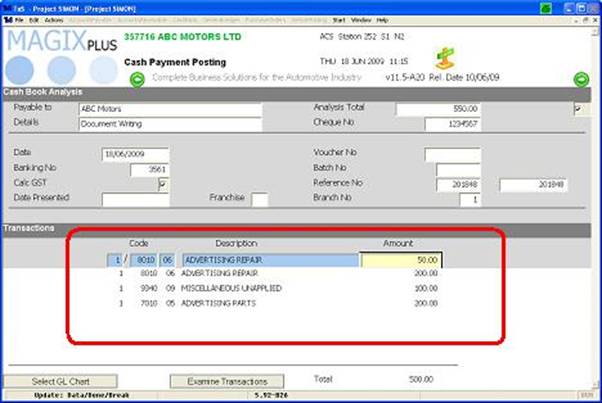

We then need to analyse the Cheque to GL Codes as we have ticked the Calc Gst it’s the full amount the system will automatically calc the GST.

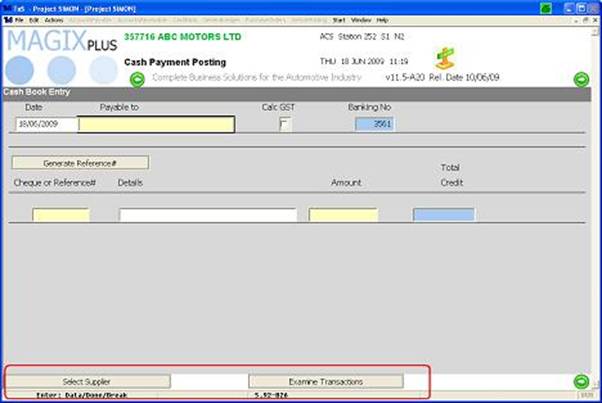

When entering a payment rather than free typing a supplier you can select supplier then enter in name a list will appear then select the supplier you are paying.

Examine Transactions will list the cheques processed in this current banking.

The only time it is important to close a Cash Payment banking is when you are back dating cheques into a previous month otherwise when you close cash receipt banking it will also close the cash payment banking.